It is against this backdrop that we are proud to say that our calls in the last year or so have mostly been spot on. To recap, we have made outright recommendations on six stocks, five listed on SGX (Memstar, Chuan Hup, PCRD, MILF, IPC) and one on Bursa (Abric). We have also, when deemed fit, made a few situational analyses (Falcon Energy, Kejuruteraan Samudra Timur, Tiger Airways), giving investors some insights into ongoing corporate actions or potential strategic options from a corporate finance perspective.

Performance of our picks

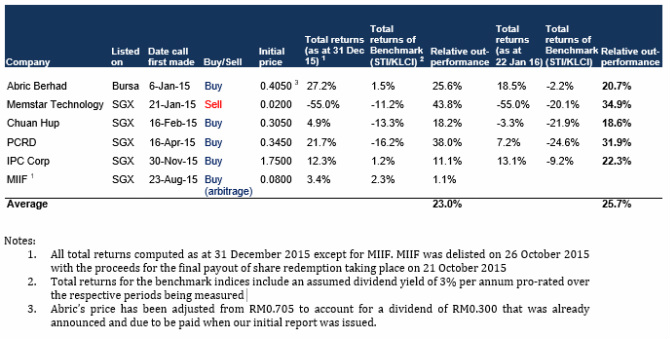

Overall, our recommendations have outperformed the benchmark indices on an absolute basis by an average of 23% as at 31 December 2015. The outperformance would have been more pronounced if annualised but we see the computation of such data misleading and academic in nature at best. The 5 buy recommendations generated an average total return (including dividends) of 13.9%. This includes the short term arbitrage of MIIF where profits were locked in after just 2 weeks. Excluding MIIF, the buy recommendations generated average returns of 16.5%. Memstar, our lone sell recommendation, was down 55.0% as at end 2015 before getting suspended for being unable to complete its reverse takeover of Longmen Group, the transaction risk of which we have flagged out multiple times over the course of the year.

A summary of our performance is presented below accompanied by key updates on selected companies that we have covered:

Abric Berhad- cash realised from impending delisting

Following a year during which Abric has failed to find a suitable acquisition opportunity for it to extend its Bursa listing, the company has announced on 18 January 2016 that it will be going ahead with a delisting exercise. In conjunction with the delisting exercise, the company has announced a cash distribution of RM0.43 per share (vs last traded price of RM 0.48), which we estimate is roughly equal to its cash holdings less all liabilities as at September 2015 on a fully diluted basis. This does not include the approximately RM0.07 cash it was due to receive 12 months after the completion of disposal in December 2014 (i.e. December 2015).

As Abric has already announced its decision to dispose of its remaining assets and voluntarily wind-up, shareholders are expected to be entitled to a further cash distribution post delisting. We think that shareholders should also be able to realise an eventual amount close to the Company’s NAV of RM0.64 per share. With a finely balanced shareholding structure (controlling Ong family owns 35%, super minority Pui Cheng Wui 23% and others 42%, fully diluted assuming full conversion of warrants), minority shareholders can also take heart that their interests should be fairly taken care of post delisting.

Memstar Technology- RTO woes not over

Memstar’s troubles in trying to complete the acquisition of Longmen Group continues unabated. In our previous report, we questioned Memstar’s over optimistic valuation of the target, then valued at US$420 million. Following the umpteenth supplemental agreement, the acquisition price has been revised downwards first to US$323 million in July, then to US$200 million in December, translating into an eye-popping 52.4% in reduction in value in less than a year! This is accompanied by a loosening in the conditions precedent of the acquisition particularly those pertaining to the Target group’s fund raising obligations. However, given the difficult current market conditions, we are still not optimistic that the conditions can be met even with the significantly lowered bar. And to add to shareholders’ woes, Memstar has suspended trading of its shares yet again on 6 January 2016.

The only silver lining in all these is in SGX’s decision to grant the Memstar additional time (until end May 2016) to complete the acquisition. We can only hope that Memstar shareholders have taken heed of our multiple warnings and disposed of their holdings in time.

Chuan Hup Holdings- hit mainly by FX losses

When we first recommended Chuan Hup, it was on the back of its extremely robust balance sheet, under-appreciated assets and the possibility of a bumper dividend arising from its disposal of CHO shares to Falcon Energy. While Chuan Hup’s financial strength and asset backing have remained largely unchanged, we were disappointed in the board’s decision not to reward its shareholders with a bigger payout. It did announce and pay a total dividend of 3 cts though for its financial year ending 30 June 2015, representing a yield of almost 10% of the prevailing price when our report was first posted.

Results wise, Chuan Hup continues to be hit by the effects of a strengthening US dollar against both SGD and AUD even if its units’ underlying businesses have not deteriorated as much. PCI, its SGX listed electronics manufacturing arm, for example, recorded a 62% plunge in its latest 1Q16 profit after tax from US$1.6 million to US$0.6 million, largely due to a US$1.5 million foreign exchange loss (vs +US$0.1mil the year before). Strip that out and adjusting for mark-to-market profits/losses and the core profit would have remained almost the same as the 1Q15’s. Similarly, a US$6.1 million hit from foreign exchange losses was the main culprit for Chuan Hup reporting a loss of US$3.9 million for 1Q16 vs a profit of US$3.0 million in 1Q15.

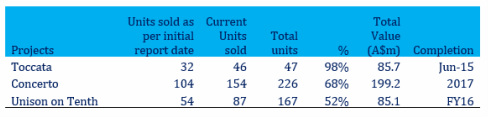

For its joint venture property development projects in Australia, the results have been mixed. Toccata, which has been completed is almost fully sold. We estimate that only 10-15% of the sales have yet to be recognised. Meanwhile, Concerto, the largest of the 3 projects by development value, has sold an additional 50 units over the past 11 months to achieve 68% in total sales. With completion due only in 2017, we believe there is still enough time for the JV to ramp up sales to 80-85% or more, similar to what Toccata achieved at its completion. Sales in Unison on Tenth, however, has made little progress in the last few months in particular and 48% of its units remain unsold despite the fast approaching completion deadline. That said, as we have stressed in our previous report, we do not expect any negative cashflow impact from these projects as Chuan Hup’s main obligations in these is in injecting the land while Finbar contributed the working capital.

As at the latest balance sheet date of 30 September 2015, we estimate that Chuan Hup still holds, after accounting for dividends paid after, adjusted net cash and short term securities worth S$0.194 per share or almost 73% of its last traded price of S$0.265, which should provide a strong buffer against the current market volatilities.

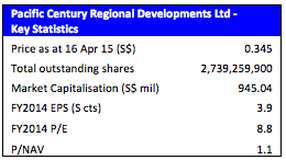

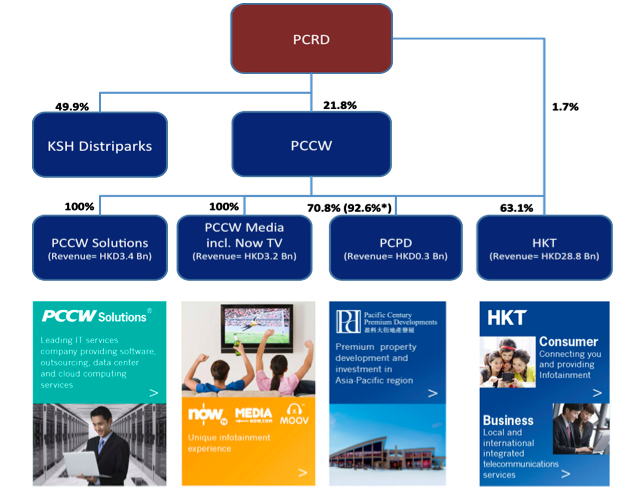

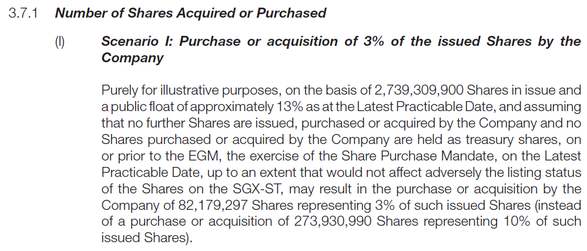

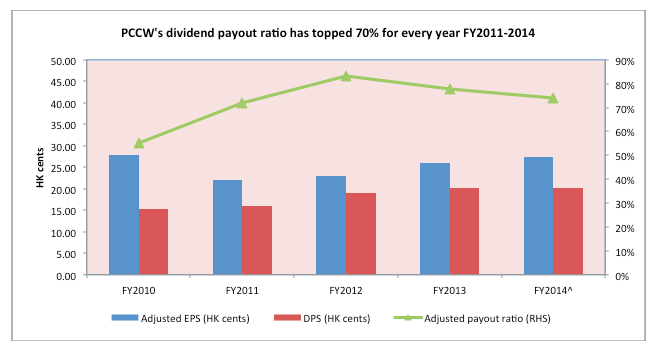

Pacific Century Regional Development- delisting imminent if share buybacks continue

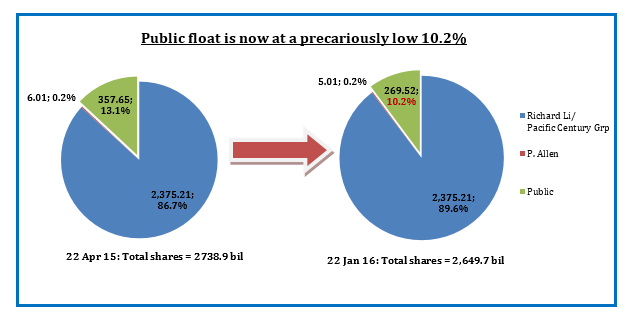

Since our report highlighting PCRD’s aggressive share buybacks and suggesting that this may be a prelude to majority shareholder Richard Li potentially privatising the company, PCRD has not shown any intent to restrain its share buyback activities. In the past 9 months, the company has acquired a further 89.1 million shares, shrinking the public float to a precariously low 10.2%. We estimate that the company can only acquire and cancel a further 5.1 million shares before its trading has to be halted pending a delisting decision to be made.

To recap a point made in our update report on 5 May 2015:

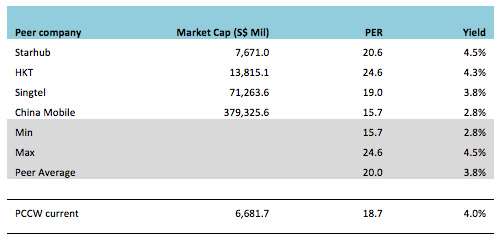

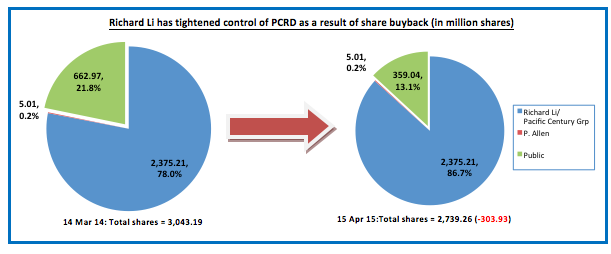

“Under the current regulatory regime, there are a few ways that PCRD's privatisation could take place: through a general offer, a scheme of arrangement, a voluntary delisting or a forced delisting by SGX due to low free float (<10%) coupled with an exit offer. Based on current circumstances, we see the last two as the most likely options. Both would require a reasonable exit offer to be tabled and the appointment of an independent financial adviser ("IFA") to opine on the fairness of the offer as stipulated in the SGX listing rules. We note that IFAs tend to benchmark fair value of a company's shares to the market prices of its underlying assets where such values are available as in the case of PCRD. As such, we do not expect any exit offer, if it materialises, to deviate greatly from the fair value computed using this methodology in order to obtain a positive recommendation from the IFA.”

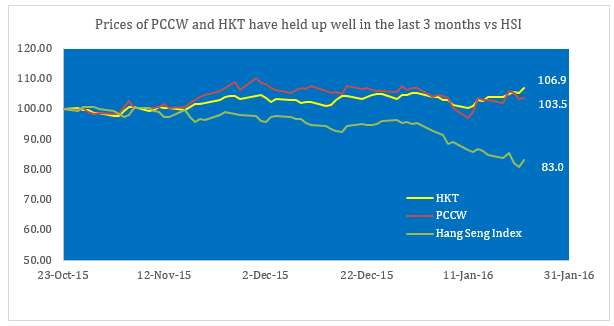

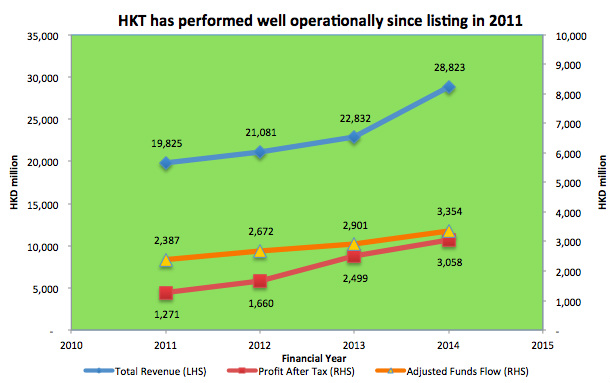

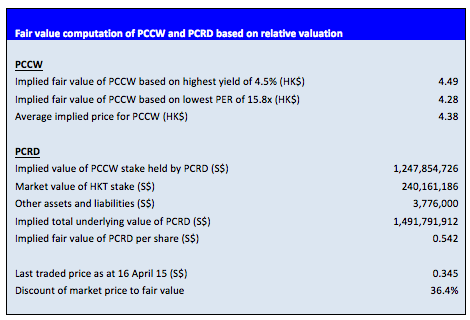

As at 22 January 2016, PCRD’s stakes in PCCW and HKT, both of which shares have held up well despite the recent market turmoil, is worth a total of S$0.61 per share. While it remains to be seen if the “reasonable” offer by Richard Li comes close to matching the market value of PCRD’s underlying assets in the event the mandatory delisting and exit offer is triggered, we believe that that any IFA appointed will use this as a benchmark to base its recommendation on. Richard Li would thus find it hard to justify offering an amount that is significantly less. With the shares trading at $0.37 as at 22 January 2016, we believe PCRD still has significant upside.

Closing note

While our first year scorecard has certainly been encouraging, our focus is solely on longer term returns. In that regard, we do not expect our picks to be able to outperform the markets by such wide margins year in year out. However, we are confident that with a relentless focus on value and our core competencies, we would be able to generate a positive return on our picks relative to the market over the long run.

RSS Feed

RSS Feed